![A accountant working on a computer shows how the nonprofit statement of financial position (or balance sheet) is created.]](https://jitasa.imgix.net/blog/nonprofit_statement_of_financial_position_feature.jpg?auto=format&w=700)

Nonprofit Statement of Financial Position (or Balance Sheet)

Thursday, October 5, 2023

There are several documents that nonprofits leverage to determine the best future financial decisions. Each one has a specific purpose and can provide important insights about your organization. The one that gives the most insight about the overall financial health of your nonprofit is known as the statement of financial position, also known as the nonprofit balance sheet.

Your nonprofit accountant or accounting team has likely put one together in the past. If not, it’s time to get started! This can help determine your capacity for growth and if your nonprofit is ready to take on new financial initiatives. It can also be used to help spot potential or current financial concerns.

Nonprofit Accounting 101 Course

Take a deep dive into some of the basics of nonprofit accounting.

Free CourseIn this guide we’ll discuss what a nonprofit balance sheet is and how you can use your statement of financial position to make the best decisions for your organization’s finances. We’ll cover the following questions:

- What is the nonprofit statement of financial position?

- Is there a difference between a statement of financial position and a balance sheet?

- What makes up your nonprofit statement of financial position?

- What insights can be determined from your nonprofit balance sheet?

- Nonprofit Statement of Financial Position Template

Ready to dive deeper into this important nonprofit financial statement? Let’s get started.

Contact a nonprofit accountant to craft and interpret your statement of financial position.

Contact JitasaWhat is the nonprofit statement of financial position?

The nonprofit statement of financial position - also called a balance sheet - is essentially a report that shows a snapshot of your organization’s financial health. It measures your nonprofit’s assets, liabilities, and net assets in a single document.

Keep in mind that this report is more accurate and helpful if your organization uses an accrual method of accounting rather than the cash method. Accrual accounting allows nonprofits to record revenue when earned and expenses when incurred rather than when the money actually enters or leaves the account (which is how cash accounting works). It provides a more accurate statement about when financial changes occurred, creating a more exact report to work off of.

Your statement of financial position will be made up of three main sections:

- Assets (what your organization owns)

- Liabilities (what your organization owes)

- Net assets (your organization’s equity)

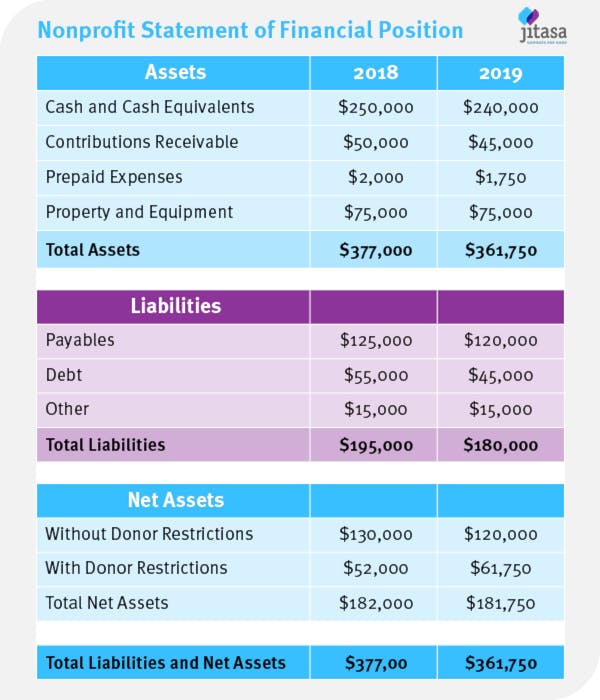

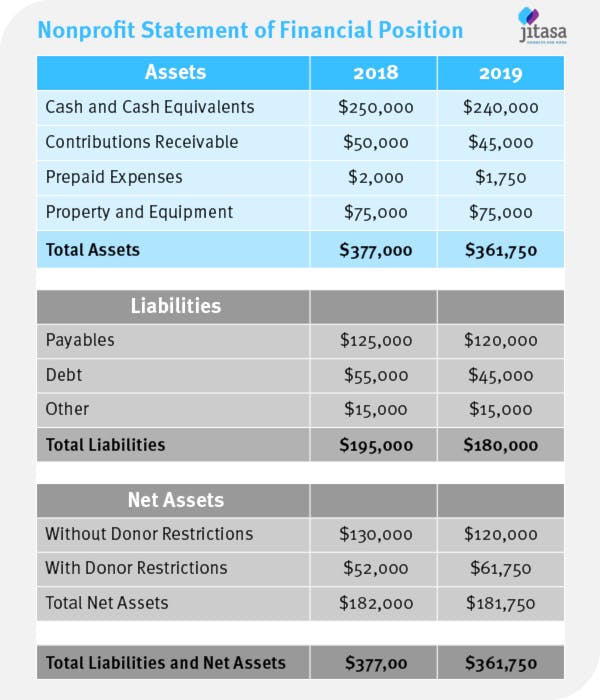

We’ll dive deeper into these three components later on. When it’s completed, your final balance sheet will look something like this:

Keep in mind that your statement of financial position is a key document for the nonprofit auditing process. Whenever you pull the report, double and triple check the numbers to be sure they’re correct. That way, when it’s time for an audit, you’ll know you’re giving them the most accurate information possible.

Is there a difference between a statement of financial position and a balance sheet?

The short answer is no. The statement of financial position and the balance sheet are two different terms that refer to the same report. Which one your nonprofit uses internally is up to you, but you should be aware of both terms because reporting organizations may ask for the statement by either name.

While “balance sheet” has been commonly used for many years, the term “statement of financial position” is more aligned with the other major nonprofit financial statements, which include the:

- Statement of activities. The nonprofit parallel to the for-profit income statement, this report summarizes your organization’s annual revenue, expenses, and net assets.

- Statement of cash flows. This statement shows how money moves in and out of your nonprofit through operating, investing, and financing activities.

- Statement of functional expenses. This report categorizes your organization’s expenditures based on the way in which each one furthers your mission.

Each of these statements is essential to provide different insights into your organization’s financial situation. Plus, they’re all useful resources when it comes to filing your organization’s annual Form 990 with the IRS.

What makes up your nonprofit statement of financial position?

The numbers pulled for your nonprofit balance sheet all come from your organization’s chart of accounts, which lists out all of your accounts and ledgers to keep your finances in order. Then, these numbers are organized into the three sections of the report (assets, liabilities, and net assets).

Assets

The assets section of your nonprofit balance sheet defines what your nonprofit owns. It includes items like your cash assets, accounts receivable, property and equipment investments, long-term receivables, prepaid expenses, and more.

Generally, these assets are listed in order of the amount of time that it would take for them to become liquid assets. For example, cash is already liquid, so it’s listed first in the assets section. Meanwhile, investments in property and equipment (like the computers you purchased to complete work) would require sale to become liquid, making them more challenging (if not impossible) to use for operating expenses.

Liabilities

In a nutshell, the liabilities section of your nonprofit statement of financial position sums up what your organization owes. This will include your accounts payable, debt, and other expenses. For instance, this is where you’ll add expenses owed to your employees, vendors, and contractors, as well as any debt your organization may have as an entity.

While your assets are generally organized by liquidity, your liabilities are usually organized by due date. Short-term investments are usually labeled as current liabilities and should be owed within the year. Meanwhile, long-term liabilities represent the obligations that can be paid over multiple years.

Net Assets

The third and final section of your statement of financial position is the net assets section. This part of the report shows the equity of your organization (your total assets minus your total liabilities).

Net Assets = Total Assets - Total Liabilities

These net assets are then split up and organized according to the restrictions placed on them. Donors, grant-makers, and government entities all reserve the right to restrict the contributions made to nonprofits so that it can only be used for certain activities or programs. That’s why it’s so important to manage grants and other restricted contributions carefully in your accounting system.

This section splits the net assets into the following restriction categories:

- Without donor restrictions. This defines the cash and assets that you have on hand and can be used at your own discretion. Much of this is found in your annual fund and can be used to fund operational expenses like salaries, rent, and utilities.

- With donor restrictions: purpose or timing. Some funds might have temporary restrictions related to a certain purpose or timing. After that purpose is no longer needed or the timing is up, the funds can be released from restriction and added to your non-restricted assets.

- With donor restrictions: held in perpetuity. These are the funds that must be held for a certain purpose no matter how much time passes. You will not be able to use this money to fund operational expenses at your organization.

This is an incredibly important part of the nonprofit balance sheet. It defines the net assets that you have available to conduct operations at your organization. For example, if you have a donation that’s restricted permanently for a certain program, you won’t have the flexibility to use that funding to increase a valuable employee’s salary or support other pressing operational expenses.

What insights can be determined from your nonprofit balance sheet?

There are several insights that you can pull from your nonprofit statement of financial position. It provides information about the overall financial health of your nonprofit. That’s because it shows the amount of flexibility you have in your funding to pay for additional operating expenses necessary for growth.

If you pull the financial information from both this year and the year prior in your nonprofit balance sheet, you can compare your financial health between the two years.

You can also measure the current liquidity of your nonprofit. Doing so can help you better understand which funds are a leverageable part of your operational budget and can be used to take on additional risk, such as expanding the organization. You can do this by calculating the months of cash and assets that your organization has on hand to pay for items outside of your usual expenses.

There are two different equations you can use to calculate this: the months of liquid unrestricted net assets (months of LUNA) and the months of cash on hand. Both are calculated using the information located in your nonprofit statement of financial position.

Months of Liquid Unrestricted Net Assets (LUNA)

To calculate your months of LUNA, you’ll need to take the total unrestricted net assets found on your nonprofit balance sheet and subtract the property and equipment assets (found in the first section). This is because those assets are tied up in physical belongings (property, software, etc.) and cannot be liquidated to cover additional liabilities. Then, divide this number by the average monthly expenses incurred by your organization. The result is the number of months that you can cover with the liquid assets you have on hand.

It’s generally recommended that organizations have the assets on hand to cover at least three months of operating expenses. Here’s what to consider when calculating months of LUNA:

- Months of LUNA < 0: This result requires immediate attention. Essentially, it means that your organization doesn’t have the cash on hand to cover your current expenses.

- 0 < Months of LUNA < 3: This result is something to keep an eye on for a single year. But if you’ve been in this position for multiple years, start considering how you can readdress your financial positioning.

- Months of LUNA = 3: This is what’s generally recommended and signifies strong financial health and stability at your organization.

- Months of LUNA > 3: This result means you have additional cash on hand, providing additional flexibility, the ability to take on new risks, and growth opportunities.

Months of LUNA is the most accurate way you can calculate the liquidity of your organization and the potential risk that you can take on because it takes into account the restricted assets at your organization, ensuring they’re only used for their intended purpose. However, you can also use the next calculation (months of cash on hand) to calculate the liquidity of your nonprofit.

Months of Cash on Hand

The second equation you can use to find the liquidity of your organization - which is also based on blance sheet data - is the months of cash on hand. Unlike the months of LUNA, this calculation doesn’t take into account the restrictions of assets. However, it is a simpler equation to calculate. You can find it by dividing the average monthly expenses by your total cash and cash equivalents.

Generally, you’ll want to have between three and six months of cash on hand to determine that your organization is in a financially stable and healthy position.

Contact a nonprofit accountant to craft and interpret your statement of financial position.

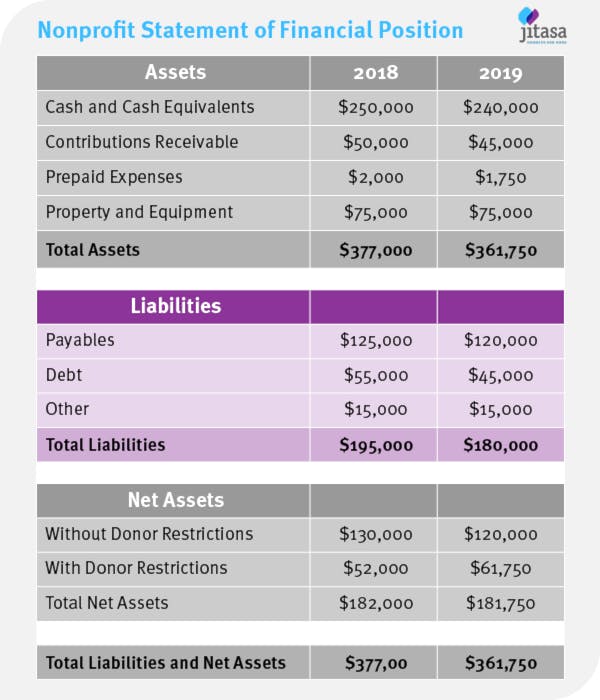

Contact JitasaNonprofit Statement of Financial Position Template

Here is a blank template that can be used to determine your own nonprofit’s statement of financial position. It can be confusing to fill this out on your own, and can indicate improper financial management if done incorrectly, which is why we recommend reaching out to an accountant to help create a balance sheet for your organization.

Wrapping Up

Your nonprofit needs to create several statements and reports to better understand your organization’s financial health and well-being. The nonprofit statement of financial position is a big one!

Reach out to a professional nonprofit accountant for help creating and interpreting your nonprofit’s balance sheet. Then, you can discuss potential next steps for your organization, whether it’s to grow and expand or to reevaluate your revenue generation and financial management.

If you want to learn more about financial statements and accounting, check out these resources:

- Establishing a Nonprofit Chart of Accounts. Learn more about the backbone of effective financial statements, your chart of accounts, with this complete guide for nonprofits.

- Restricted Funds: What Are They? And Why Do They Matter? Dive deeper into a highly nonprofit-specific element of your organization’s balance sheet: the inclusion of restricted funds.

- Bookkeeping and Accounting Services Exclusively for Nonprofits. Get in touch with a nonprofit accountant to help with your statement of financial position.

Want to make the most of your nonprofit statement of financial position?

Get in touch with a Jitasa expert today.

Learn more